child tax credit 2022 income limit

The Child Tax Credit. 239 thoughts on 2022-2023 Earned Income Tax Credit EITC Qualification and Income Limit Tables Latest News.

The 2022 Irish Budget Has Been Announced Activpayroll

This year we are forecast to borrow 71 of GDP or 177 billion.

. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit. Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year. The maximum weekly childcare costs you can claim for and percentage of costs covered are shown below.

The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children. Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to 17. This 2022 tax year the limits and thresholds of your QBI 2022 is 340100 married filing joint 1040s and 170050 for all others has increased before phase-in limits start.

Rates per week 2022 to 2023. Tax Changes and Key Amounts for the 2022 Tax Year. Mar 2 2022 754 AM.

To qualify for the maximum amount of 2000 in 2018 a single. Number of Children x. The first one applies to the.

Dependent child must be under age 17. Families must have at least 3000 in earned income to claim any portion of the credit and can receive. Then by 2027-28 it falls to 24 of GDP or 69 billion.

Filers are eligible for full credits if their incomes are up to. This is up from 16480 in 2021-22. 2022 rules youll use for filing.

The child tax credit CTC will return to at 2000 per child in 2022. To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year. Parents with higher incomes also have two phase-out schemes to worry about for 2021.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and. What is the income limit for Child Tax Credit 2022. If you are not eligible for the child tax credit and your dependent child is beyond the age of 17 or you assist a friend or family you may still be eligible for the other dependent credit of up to.

The maximum child tax credit amount will decrease in 2022. These FAQs were released to the public in Fact Sheet 2022-28PDF April. If you earn more than.

Will be able to receive the full. Childcare element of Working Tax Credit. Your credit amount is a percentage of your care-related expenses which are subject to an earned income limit and a dollar limit.

According to Pennsylvanias official. The Child Tax Credit will help all families succeed. The earned income tax credit EITC gives a tax break to workers in the middle and lower-end of the income scale.

Thats because the child tax credit is dropping to 2000 for the. A single taxpayer with 2 qualifying children and modified adjusted gross income MAGI of 80000 can claim a Child Tax Credit of 1750. The credit can be worth up to 2000 per child and it can be used to offset taxes owed.

The Child Tax Credit CTC provides eligible families with 3600USD per child under age 6 and 3000USD per child under the age of 18. The 1 priority for progressives is to restore several elements of the expanded CTC Congress enacted temporarily in 2021. The taxpayers earned income and their adjusted gross income AGI.

Under the Build Back Better Act you generally wont receive monthly child tax credit payments in 2022 if your 2021 modified AGI is. The Child Tax Credit limit is 75000 for single filers and 110000 for joint filers. Two Factors limit the Child Tax Credit.

2021-2022 Earned Income Tax Credit ARPA Expansion. Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. Credit per dependent child.

The percentage is based on your adjusted gross. Next year 55 of GDP or 140 billion.

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

2022 Child Tax Credit What Will You Receive Smartasset

The American Families Plan Too Many Tax Credits For Children

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos

Smotrite Populyarnye Video Ot Child Tax Credit 2022 Tax Return Tiktok

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

2022 Child Tax Credit Legal Guide Rocket Lawyer

Child Earned Income Tax Credits 02 16 2022 News Auburn Housing Authority Auburn Alabama

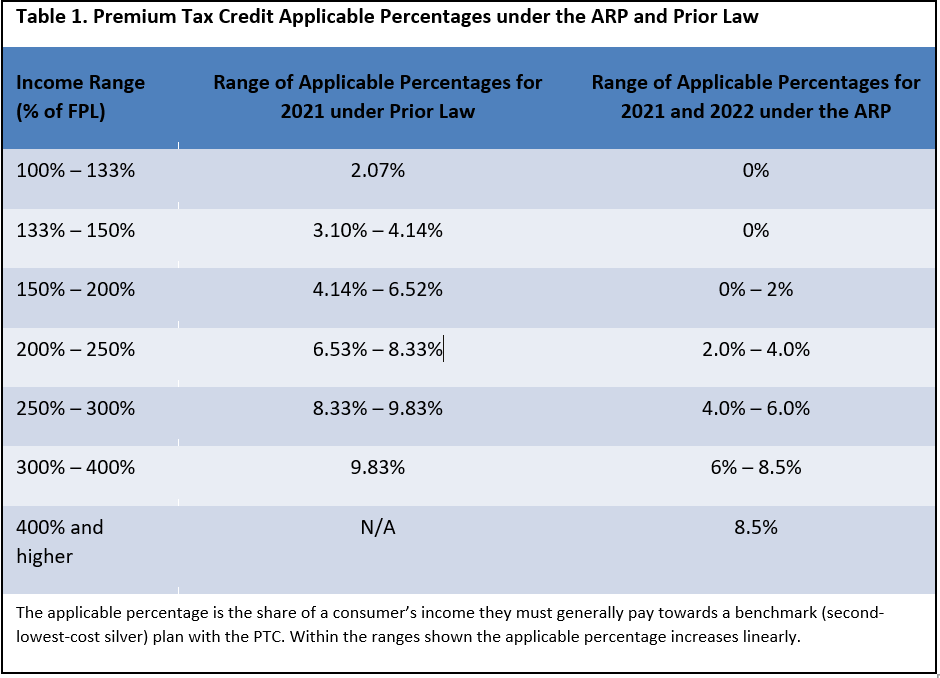

The American Rescue Plan S Premium Tax Credit Expansion State Policy Considerations

Ctc Cdctc Research Analysis Learn More About The Ctc

What Is The Child Tax Credit And How Much Of It Is Refundable

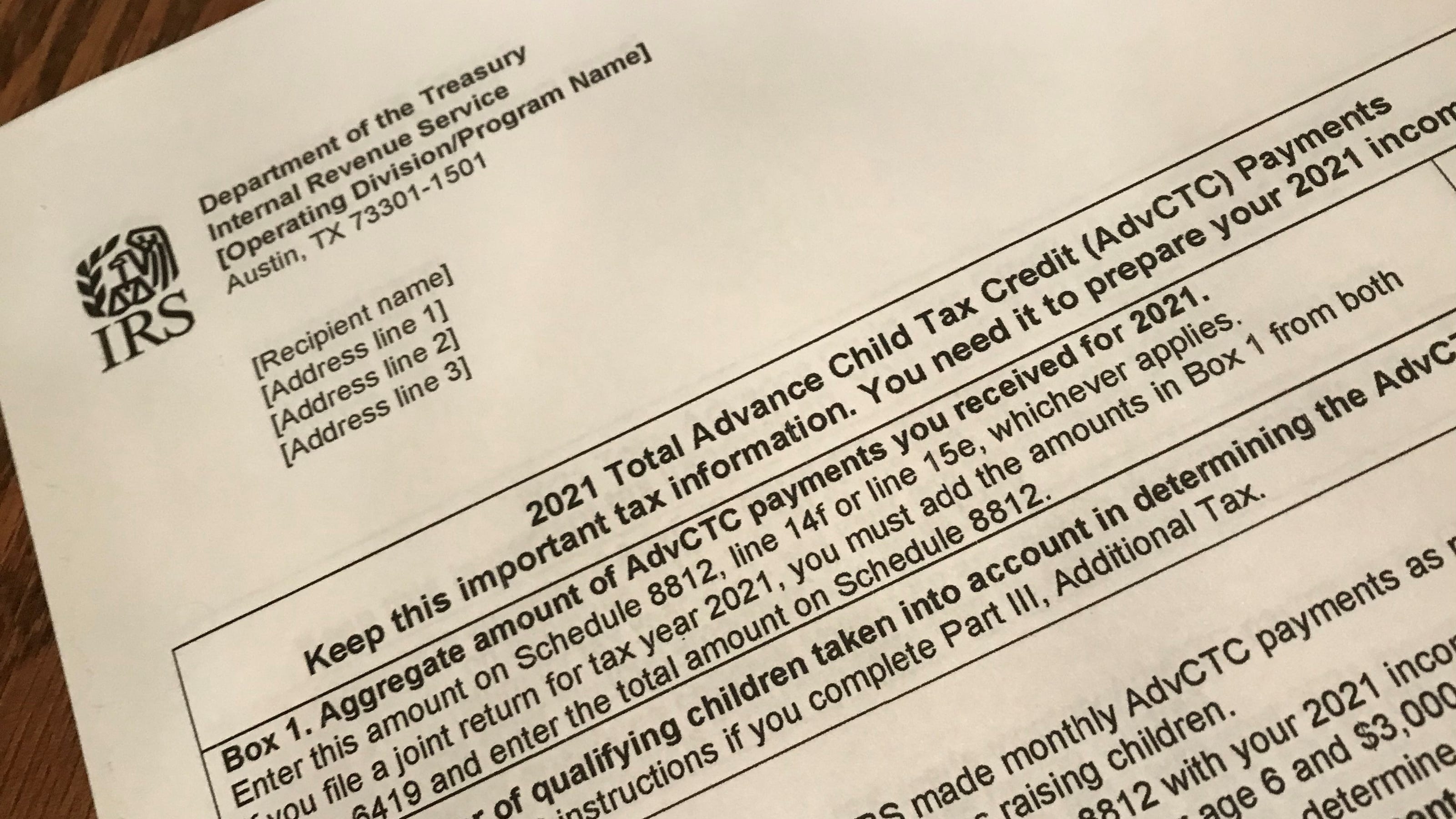

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Hispanic Svs Council On Twitter You Can Still Claim The Child Tax Credit Even If The Filing Deadline Has Passed And Even If You Had 0 Income In 2021 You May Be

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger